Are your business expenses out of control? If you have lost control of your income and expenses, you need to get back on course quickly before things get out of hand. Poor finances or cash flow is usually cited as one of the reasons for business failure, and as such, this problem, if not checked and corrected, can be the start of many businesses. But where do you start, and how can you find the right places to cut back?

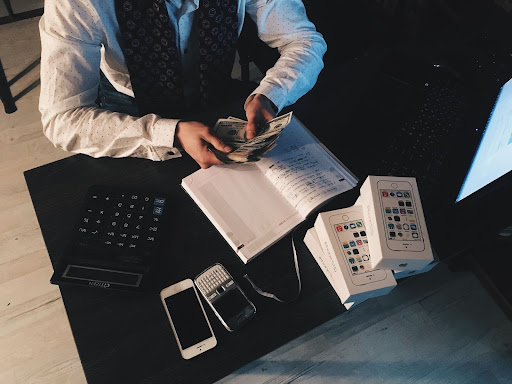

Income and Expenses

Before you do anything, sit down and check your numbers. You need to know where every penny is going and how important it’s for the operation. Then you need to track your income and see how it’s getting used within the company.

Once you have your numbers, you can then make a plan to overhaul your finances and get things right.

Make a Good Cash Flow Forecast

Once you have identified all your income and expenses, it is a good idea to include them in a cash flow forecast. A cash flow forecast is a model that enables you to view all upcoming credits or invoices due within a certain period and your expenses for the same period. This could be whatever week is best for your business. Get this up and running for at least the next three months. From here, you can calculate your net cash balance and know when a few weeks or months might be leaner, allowing you to budget properly for these times. The more prepared you are for the times when you may struggle to cover your bills, the easier it is going to be to come up with a plan to deal with as much of this as possible and identify the true health of your business.

Waste Identification

There are likely to be many areas of waste in your operation. If you focus on your spending, likelihood is things will slip through the net. Use your numbers to identify where these areas are and why spending is getting out of hand in these particular areas.

Once you have a dealership idea, you can implement a plan to reduce waste, whether it is determining how to do it reduce production costs, reduce wasted employee hours or automate processes to reduce costs and increase efficiency in numerous departments; You need to take each point and look for methods to improve what you are doing to reduce costs without compromising on quality.

Communicate effectively

Effective communication very important both internally and externally. Your employees need to know where you can be found, and the heat is appropriate in terms of spending the company money, including staffing overtime, buying equipment, authorizing payments, and so on. Everyone needs to be on the same page with regard to all financial decisions to make sure you stay on course.

You also need to communicate with suppliers and clients about when you pay bills and when customers pay you for services or products provided. Be clear and explicit about your payment permissions and look at implementing credit control methods to make sure you get the payments you expect when you expect them and do not turn into old debt.

Trade Difficulties First

Does your industry tend to use price fluctuations? For example, florists can expect to pay higher fees around demand seasons such as Mother’s Day or Valentine’s Day. At the same time, shortages of stock or fresh produce as a result of bad climatic conditions may affect the wholesale costs of vegetables and fruits. By staying abreast of changes and fluctuations in your industry, you can plan ahead for instances when business may be reduced, you have high demand, or even anticipate rising taxes or fuel costs as a result of the current economic climate. Being able to budget in advance can ward off financial difficulties and let you adjust your forecasts to maintain more control.

Conclusion

Neglecting your finances in business can have dire consequences. With nearly 50% of businesses failing within the first five years, the ability to avoid this destiny can help you present your company in the best light possible and ensure longevity so long as possible.

Your finances are the backbone of your company, and ensuring you are in charge of everything financially is critical to your long-term success. These tips can help you avoid some of the common pitfalls small businesses face and put yourself in the best shape possible for achievement.