If the way of collecting money, saving and investing in order to build a retirement fund has worked in the past, things are different now, particularly considering the recent pandemic. It’s possible that making all the right investment decisions is the only way to make your money work harder for you and make sure you achieve the level of quality of life you desire.

However, there’s all the time a measure of risk related to investing, which must be considered. For the best chance of minimizing risk and reaping the greatest returns, it is essential to diversify your portfolio. Depending on your financial situation, you should diversify your investments into stocks, real estate, and even your own corporate ventures to maximise your returns. There are many alternative ways to invest your money. Which one you choose depends fully on how much capital you must start with and the level of risk you are ready to take.

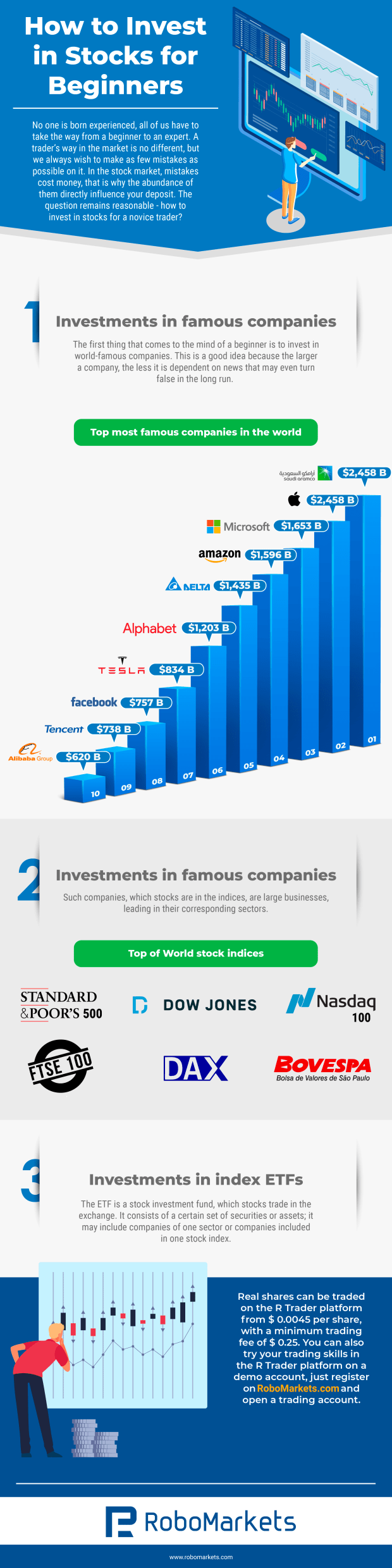

Real estate is all the time a popular choice if you have a decent amount of capital to invest. People have all the time needed housing, and that can be something to pass on to your dependents. The problem with property is that it isn’t a really liquid asset – if you need cash fast that can be a problem. Investments with more liquidity may include stocks and stocks. This may sound complicated to those who aren’t familiar with stock and stock trading, but the infographic below breaks it down simply. Look!

Infographic Design by RoboMarkets RoboMarket